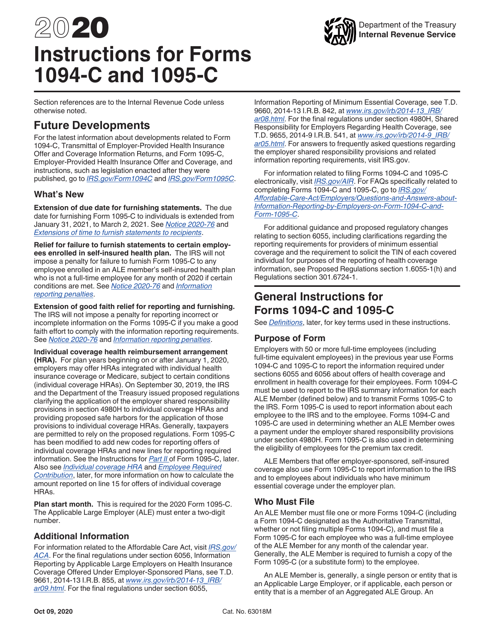

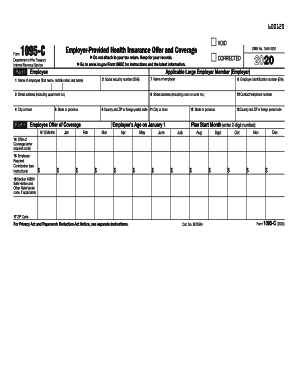

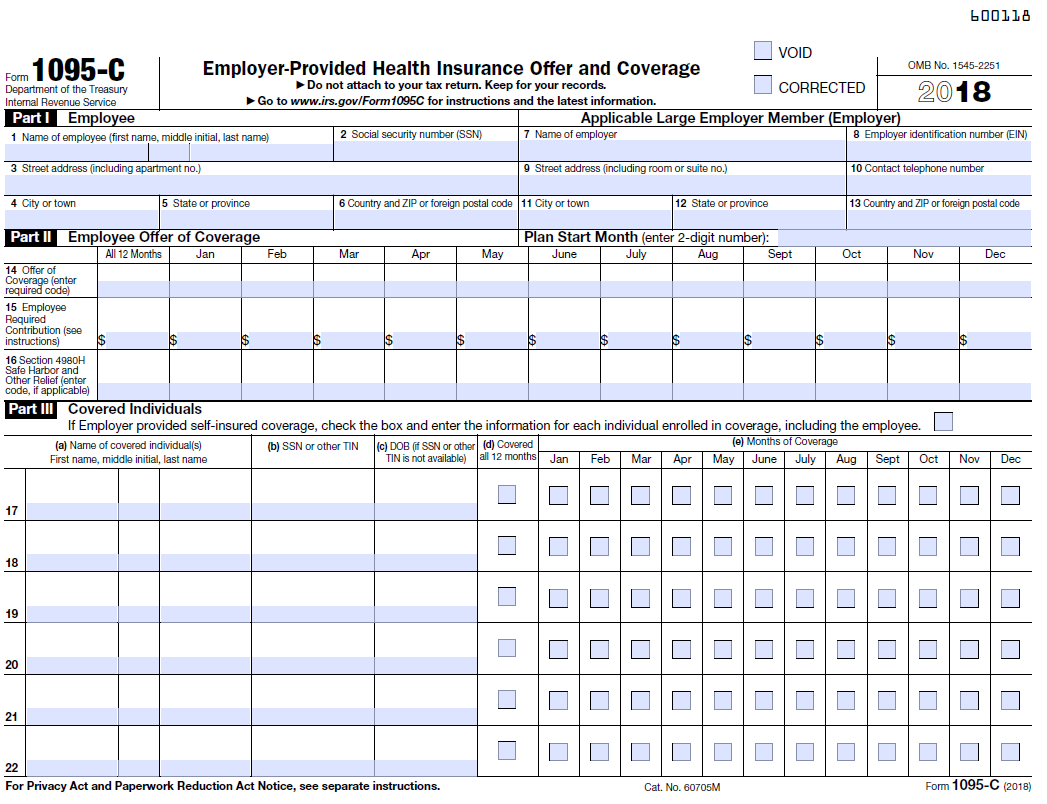

1095C Consent 5 A popup box will appear allowing you to consent to receive the 1095C form electronically Once you give consent, you can access 1095 Cs for previous years immediately and for as soon as it is available If consent is given before 1095Cs are printed by the state, a 1095C will not be mailedForm 1095C (21) Page 2 Instructions for Recipient You are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by your employer Form 1095C, Part Sample Excel Import File 1095B xlsx What's New for Line 8 Added new code "G" Individual coverage health reimbursement arrangement (HRA) Import Form Fields Field Name Size 1095B Form IRS 1095B Form

Form 1095 A 1095 B 1095 C And Instructions

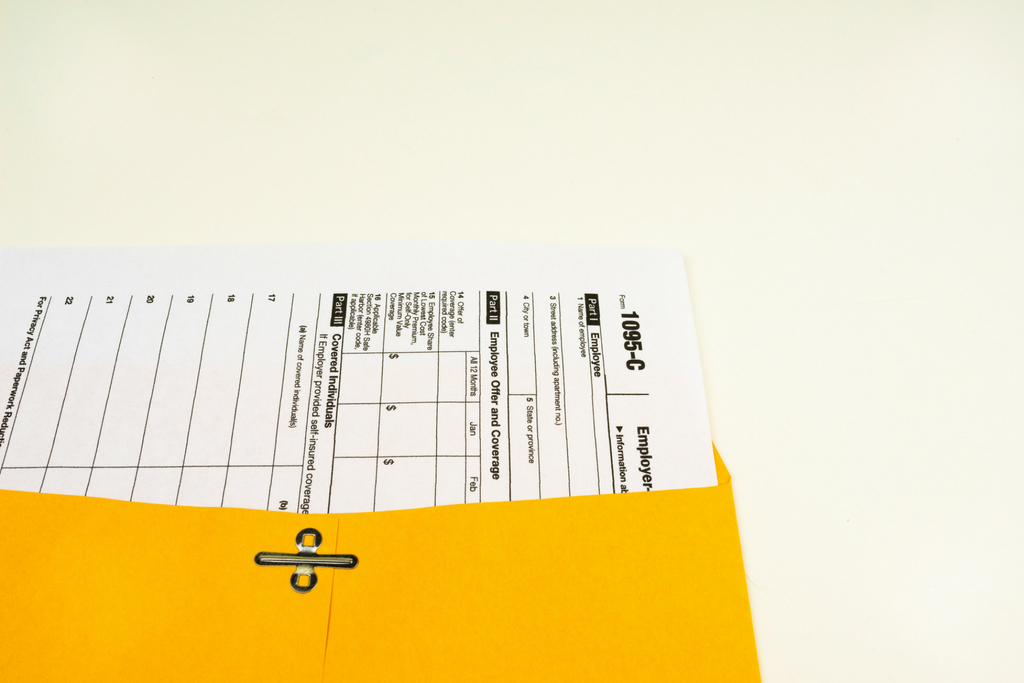

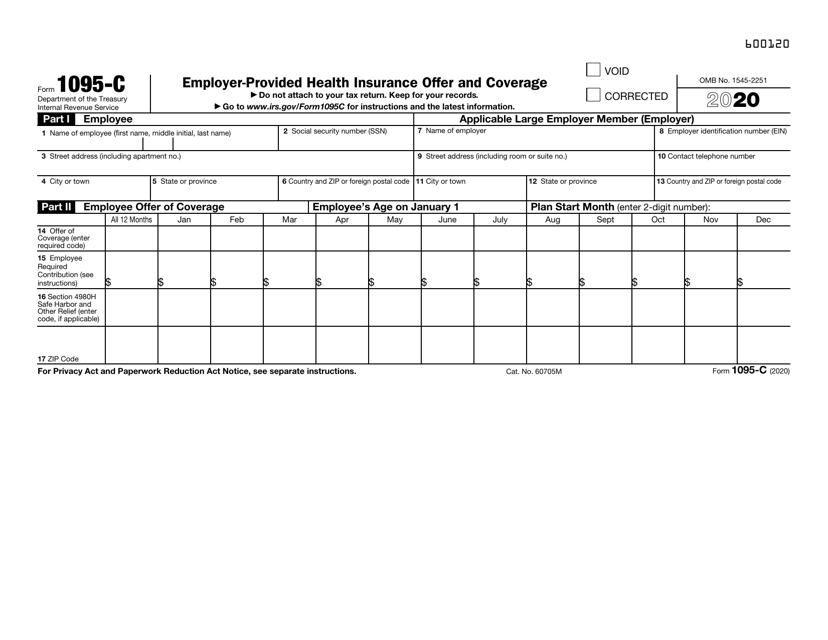

Sample 1095 c form 2020

Sample 1095 c form 2020- The IRS released for comments a draft of Form 1095C Employers will use the final version early next year to report on health coverage in The revisions add a second page to the form and mayFilling out Form 1095C 2D The EE was in a Limited Nonassessment Period (LNAP) for the month 2E You are eligible for the multiemployer interim relief rule 2F The coverage you offered is affordable based on the Form W2 Safe Harbor 2G The coverage you offered is affordable based on the Federal Poverty Line safe harbor

Irs Health Coverage Reporting Form 1095 C Examples For Youtube

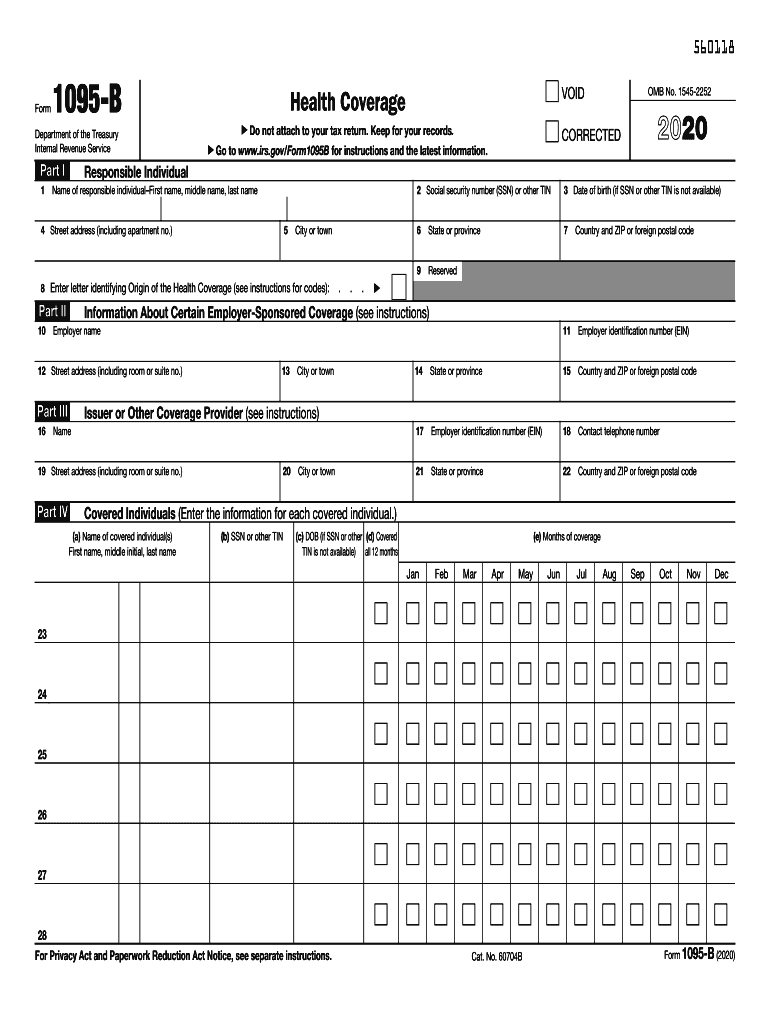

Self‐insured employers must report offers of COBRA coverage Employers complete Form 1095‐C providing COBRA coverage information (enrollment in COBRA coverage) How the Form 1095‐C is completed will depend, in part, on whether the employee was covered as an active employee during 18The information contained on these forms will help you complete your tax return Form 1095B, Health Coverage If you are enrolled in FEHB, your health plan will send an IRS Form 1095B to you and will report coverage information about the individuals covered under your health plan for some or all months duringSample Form 1095B Form 1094C and Form 1094C Instructions Sample Form 1095C ACA 1094/1095 Reporting Requirements for 6 Guidance for Applicable Large Employers ACA 1094/1095 Reporting Requirements for 7 Coding Tips for 1095 Filings NAHU, the National Association of Health Underwriters, provided a webinar on this topic for the

1095C Form Download ACAPrime "C Forms" Template According to the IRS, as long as an employer obtains prior consent (electronically), the employer can distribute forms 1095C to employees through email or other other electronic methodSample Output 1094B/1095B and 1094C/1095C Upload Specifications Files must be created using a piped delimited text (txt) file format XML, Zip or compressed files will NOT be accepted Files 250MB or larger must be submitted as multiple submissions Files that are 250MB orSEBB Data for Form 1095 Reporting Addressing questions during the webinar •Please use the "questions" feature to send questions throughout the webinar •We will address questions •Throughout the presentation when appropriate –by topic •At the end of the presentation –in summary –as time allows •Questions not answered during the presentation will be addressed the

Sample 1095C tax form Q How will I receive Form 1095C?Form 1095A is provided here for informational purposes only Health Insurance Marketplaces use Form 1095A to report information on enrollments in a qualified health plan in the individual market through the Marketplace As the form is to be completed by the Marketplaces, individuals cannot complete and use Form 1095A available on IRSgovThe form 1095C for 21 is a form that is used to report information about the health coverage that an individual has In order to receive 1095 C Tax form credits or subsidies, the individual must have coverage that meets the minimum standards set by the Affordable Care Act Form 1095C is usually filed by the individual's employer

Irs Form 1095 C To Be Distributed Hub

2

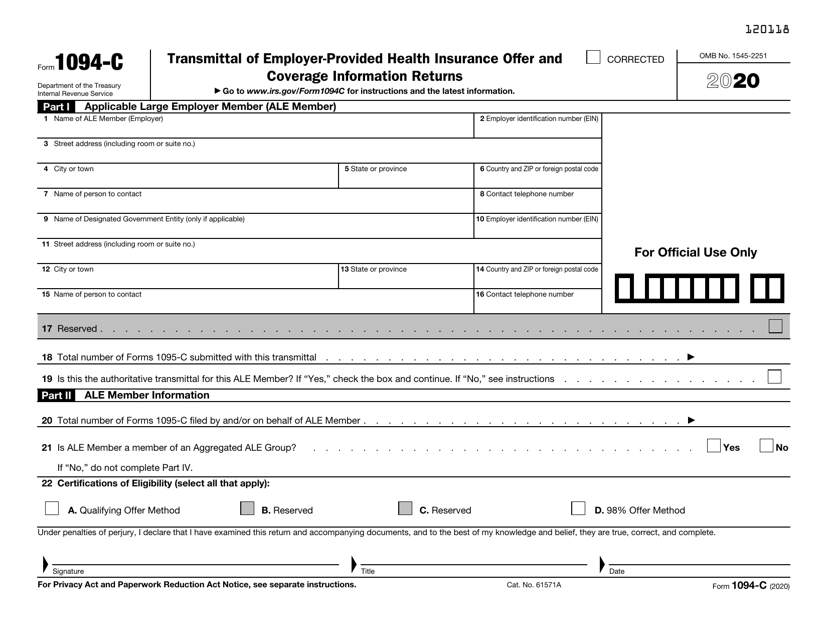

Step 5 Print Tax Form 1094C Click the top menu "Current Company" then the sub menu "Form 1094C" to view 1094C screen Note ez1095 software can print both 1095C and 1094 C forms for IRS and recipients on white paper No preprinted form is needed IRS changed form format in Year The Form has 2 pages1218 Form 1094C () Page 2 Part III ALE Member Information—Monthly (a) Minimum Essential Coverage Offer Indicator Yes No (b) Section 4980H FullTimeNo sweat Get a 30day extension by submitting Form 09 If you still miss the deadline, you can petition to get your fine waived, but only if you have a legitimate reason

1095c Form Acaprime Com

2

Forms 1094B and 1095B # Publication 35C, California Instructions for Filing Federal Forms 1094C and 1095C Checkbox on Form 540/Form 540NR/Form 540 2EZ for fullyear health care coverage You will check the "Fullyear health care coverage" box if you, your spouse/registered domestic partner (RDP) (if filingCreating the 1095C spreadsheet to be imported Although you can create your own spreadsheet to import 1095C information for your clients' employees, we recommend that you use the 1095C template spreadsheet that we have made available for exportThe 1095C template spreadsheet exports from Accounting CS populated with basic employee information that is formatted toThe individual shared responsibility payment is not applicable for tax year You do not need form 1095C to complete your taxes Form 1095C does not get filed with your tax return Keep a copy of the form with your tax records for future reference If you have any questions about the information contained on the 1095C form, please

Ez1095 Software How To Print Form 1095 C And 1094 C

2

Dex Number (CIN) 19 Coverage provided on this Form 1095B is current as of the date below Instructions Part I This section will contain the personal information from the MediCal record for the person receiving health coverage for the tax year shown in the upper right corner of this form This information should be correct Form 1095C with the FTB reporting health coverage to employees, the employer offering the health coverage is for instructions to complete federal Form 1095C, Parts I, II, and III DRAFT FILE Title California Instructions for Filing Federal Forms 1094C and 1095C, FTB Publication 35C Author Webmaster@ftbcagovReference Guide for Part II of Form 1095C Lines 14, 15, and 16 (revised for the final 17 forms) November 17 • Lockton Companies L O CKT O N CO M P ANIES GLOSSARY Children means an employee's biological and adopted children (including children placed with the employee for adoption), from birth, adoption, or placement through the end of the month in which the child

Form 1095 A 1095 B 1095 C And Instructions

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Here's the deal Give the 1095C to your employees by Send the 1094C and 1095C to the IRS by February 28, or if you plan to submit it online Can't make it?Sample 1095 C form for Year and later Sample 1095 C form for Year 15 to 19 Page 2 FTB Pub 35C (NEW ) California Instructions for Filing Federal Forms 1094C and 1095C References in these instructions are to the Internal Revenue Code (IRC) as of , and to the California Revenue and Taxation Code (R&TC) What's New

Questions Employees Might Ask About 1095 C Forms Bernieportal

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

ACA Form 1095C Codes Sheet An Overview Updated 800 AM by Admin, ACAwise The IRS requires ALEs to report their employee's health coverage information onMost popular forms Election Form Form TSP1 Use this form to Start, stop, or change the amount of your contributions (including contributions toward the catchup limit if you're turning 50 or older) Return the completed form to your agency's personnel or62 Review and update Form 1094C before mailing or efiling forms to IRS Note IRS changed form format in Year The Form has 2 pages Year 1519 form has only one page;

Irs Form 1095 C Codes Explained Integrity Data

Free 1095 C Resource Employee Faqs Yarber Creative

Each mailing of a Form 1095B will contain a letter explaining the purpose of the Form 1095B DHCS uses three different letters when mailing Form 1095Bs Sample Original Letter This is mailed with original Form 1095Bs for a given tax year This is the letter used for DHCS' annual Form 1095B mailing Sample Original Letter (English) IRS Releases Instructions for Forms 1094C and 1095C with Most Substantial Changes in Years On the IRS finally released its draft instructions for the Forms 1094C and 1095C Confusingly, the IRS appears to have released the final instructions the next day This is disappointing as commenters will not get to be heardForm 1095C Department of the Treasury Internal Revenue Service EmployerProvided Health Insurance Offer and Coverage Do not attach to your tax return Keep for your records Go to wwwirsgov/Form1095C for instructions and the latest information VOID CORRECTED OMB No Part I Employee 1 Name of employee (f

What Are The Differences Between Form 1095 A 1095 B And 1095 C

Form 1095 A 1095 B 1095 C And Instructions

566 1094C and 1095C Sample Instance 22 567 1094C and 1095C Business Rules 23 1094 1095 Technical Specifications 1 P a g e 1 What's New This Year testing On this page, transmitters will indicate what form type they intend to support and provide the ReceiptIDs of the transmissions they believe View a sample 1095C form The deadline for employers to provide the 1095C for tax year to eligible individuals is Individuals do not need to send this form to the IRS when filing their tax return, but should keep it with their tax records Next Next post Form 1095C Draft for Tax Year Released by IRS All content is for informational purposes only and does not provide tax advice BoomTax cannot guarantee that such information is accurate, complete, or timely Always consult an attorney or tax professional regarding your specific legal or tax situation

Amazon Com 18 Complyright 1095 C Employer Provided Health Insurance Offer And Coverage Form And Envelopes Bundle For 100 Employees Office Products

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

After you import data, you can click the top menu "Current Company" then "Form 1095B" to view the form list Please do not forget to click the "Refresh List" button 62 Review, update and print 1095 ACA Forms for employees You can select one form from list to review the data, edit form, print form or generate efile documentForm 1095A rather than a Form 1095B If you or another family member received employersponsored coverage, that coverage may be reported on a Form 1095C (Part III) rather than a Form 1095B For more information, seeB1 Understanding the Sources for Forms 1095C and 1094C and1095C XML The Form 1095C print and the 1094C or 1095C XML files are handled through the JD Edwards Electronic Document Delivery (EDD) system The system uses the data item aliases during the spool file batch export step to create XML source files, which are then used to map the information to

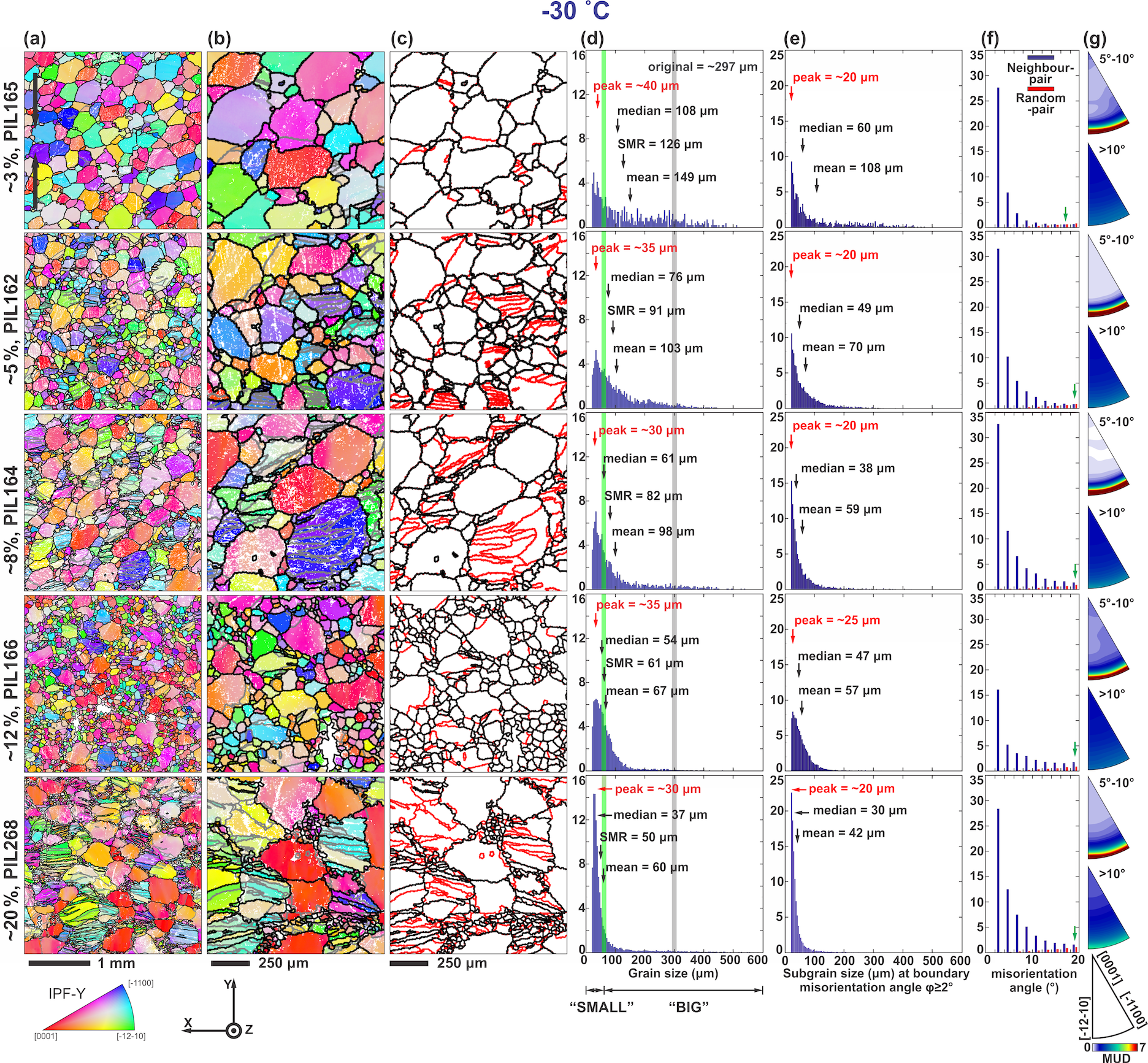

Tc Temperature And Strain Controls On Ice Deformation Mechanisms Insights From The Microstructures Of Samples Deformed To Progressively Higher Strains At 10 And 30 C

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Form 1095A Health Insurance Market Place Statement; The new form covers HRA plan years starting New codes for the 1095C For tax year , Form 1095C gets updated with brandnew offer codes employers can enter in line 14 You'll use it to indicate the type of HRA coverage offered to employees1095B, Health Coverage, or 1095C, EmployerProvided Health Insurance Offer and Coverage;

The Irs Wants To Know Has Your Company Filed Form 1095 C

Spreadsheet Import Form 1095 C

Sample Excel Import File 1095C xlsx In Part 2, added field "Employee's Age on January 1" before the Plan Start Month field New codes for line 14 "Offer of Coverage" 1L, 1M, 1N, 1O, 1P, 1Q, 1R, 1S New field, line 17 "Zip code"C DOB (if SSN is not available) 4643 Briarwood Road Springfield MO 1769 Filbert Street Philadelphia PA 5 6 6 6 0 2 Social security number (SSN) 3 Street address 3 Street address 2 4 City or town 6 Country code 6 Zip or foreign postal code 5 State or province 1 Employee first name 1Series 1 and Code Series 2 in lines 14 and 16 of Form 1095C The IRS will then review the codes used and determine whether you are compliant with your employer mandate ACA requirements ACA FORM 1095C CODE SERIES The IRS has designed two sets of ACA codes to provide employers with a way to describe health coverage offers on Form 1095C

Aca Code Cheatsheet

Affordable Care Act Aca Ability To Generate 1095 B And 1095 C Forms Microsoft Dynamics Ax Community

The Form 1095C is the EmployerProvided Health Insurance Offer and Coverage, designed by the IRS to capture enough information about the employer's offer ofInst 1094C and 1095C Instructions for Forms 1094C and 1095C Form 1095A Health Insurance Marketplace Statement 21 Inst 1095A Instructions for Form 1095A, Health Insurance MarketplaceHow to complete Form 1095C In order to stay compliant with the Affordable Care Act in 16, companies with a fulltime staff of 50 or more will need to file a Form 1095C for each employee We'll help you figure out how it works

Annual Health Care Coverage Statements

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

New health care forms Draft California forms and instructions are on our website Final versions are expected to be available onA 1095C documents will be mailed to active and former employees who were fulltime (worked an average of 30 or more hours per week) or were enrolled in the company's health insurance plan in by to the last updated address in our systemForm 1095C merely describes what coverage was made available to an employee A separate form, the 1095B, provides details about an employee's actual insurance coverage, including who in the worker's family was coveredThis form is sent out

1095 C 1094 C Aca Software To Create Print E File Irs Form 1095 C

1094 C 1095 C Software 599 1095 C Software

Common 1095 C Coverage Scenarios With Examples Boomtax

Irs Form 1095 C Fauquier County Va

Sample 1095 C Forms Aca Track Support

Changes Coming For 1095 C Form Tango Health Tango Health

New 1095 C Codes For Tax Year The Aca Times

2

Locating Transmission Information For Corrected Form 1094 C And 1095 C Internet Files

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

Aca Forms 1094 C And 1095 C And Reporting Instructions For The Aca Times

Aca Reporting Penalties Newfront Insurance And Financial Services

Accurate 1095 C Forms Reporting A Primer Integrity Data

1095 Express Software 1099 Express

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Aca Reporting Road Map

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

The Complete J1 Student Guide To Tax In The Us

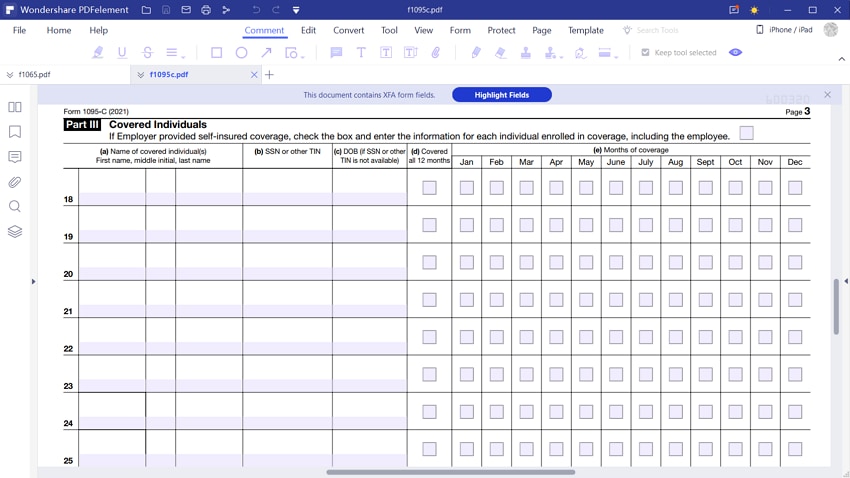

Irs Form 1095 C The Best Way To Fill It Out Wondershare Pdfelement

Affordable Care Act Aca Reporting Cheat Sheet Reporting Made Easy Onedigital

2

Irs Form 1095 C Download Fillable Pdf Or Fill Online Employer Provided Health Insurance Offer And Coverage Templateroller

Form 1095 C Forms Human Resources Vanderbilt University

1

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Large Employers What Are The Deadlines For Forms 1094 C And 1095 C Mitchell Wiggins

Control Files And Sample Forms

What S New For Tax Year Aca Reporting Air

Common 1095 C Coverage Scenarios With Examples Boomtax

2

Irs Health Coverage Reporting Form 1095 C Examples For Youtube

Tc Temperature And Strain Controls On Ice Deformation Mechanisms Insights From The Microstructures Of Samples Deformed To Progressively Higher Strains At 10 And 30 C

1094 C 1095 C Software 599 1095 C Software

Form Irs 1095 B Fill Online Printable Fillable Blank Pdffiller

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Irs Form 1094 C Download Fillable Pdf Or Fill Online Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns Templateroller

Print And Fill In 1095 C Fillable Form In 100 Free Cocosign

S 1

Irs 1095 C Form Pdffiller

3

Updated Sample Employee Letters For Irs Forms 1095 B And 1095 C Kistler Tiffany Benefits

1

Form 1095 C Guide For Employees Contact Us

1095 C Form Official Irs Version Discount Tax Forms

1095 C Print Mail s

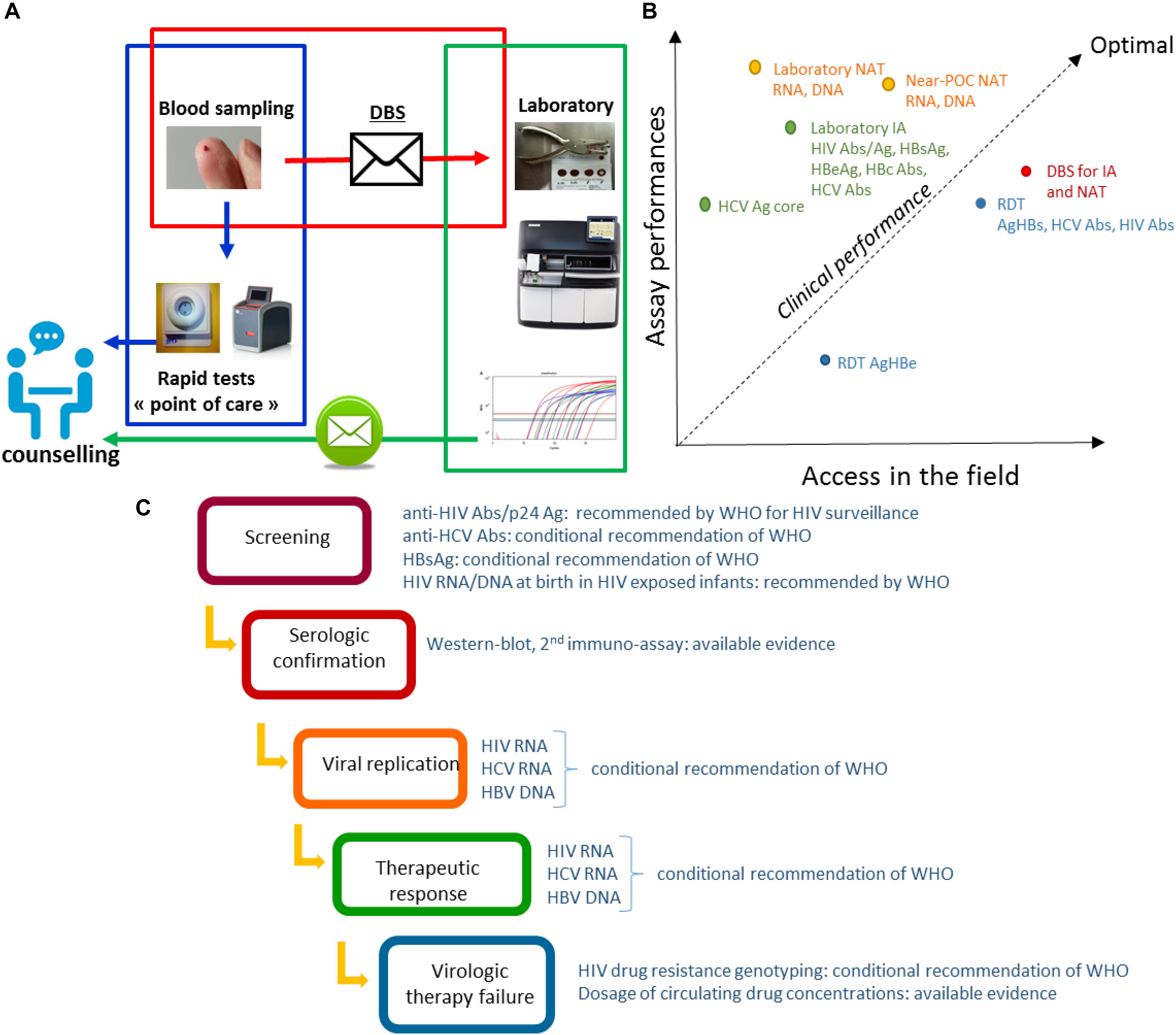

Frontiers Dried Blood Spot Tests For The Diagnosis And Therapeutic Monitoring Of Hiv And Viral Hepatitis B And C Microbiology

2

Sample 1095 C Forms Aca Track Support

Covered California Ftb 35 And 1095a Statements

1095 C 18 Public Documents 1099 Pro Wiki

Employers Are You Unsure Of The Coding On Forms 1094 C And 1095 C The Aca Times

Form 1095 C Forms Human Resources Vanderbilt University

2

Irs Extends Form 1095 Furnishing Deadline And Other Relief

3

Print And Fill In 1095 C Fillable Form In 100 Free Cocosign

Spreadsheet Import Form 1095 C

Irs 1094 C Form Pdffiller

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Control Files And Sample Forms

Form 1095 A 1095 B 1095 C And Instructions

Instructions For Forms 1095 C Taxbandits Youtube

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

:max_bytes(150000):strip_icc()/Schedule-C-1040-Form-b15a78b583c04e4b80c96ff1d0fee048.png)

What Is Schedule C On Form 1040

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

trix Irs Forms 1095 B

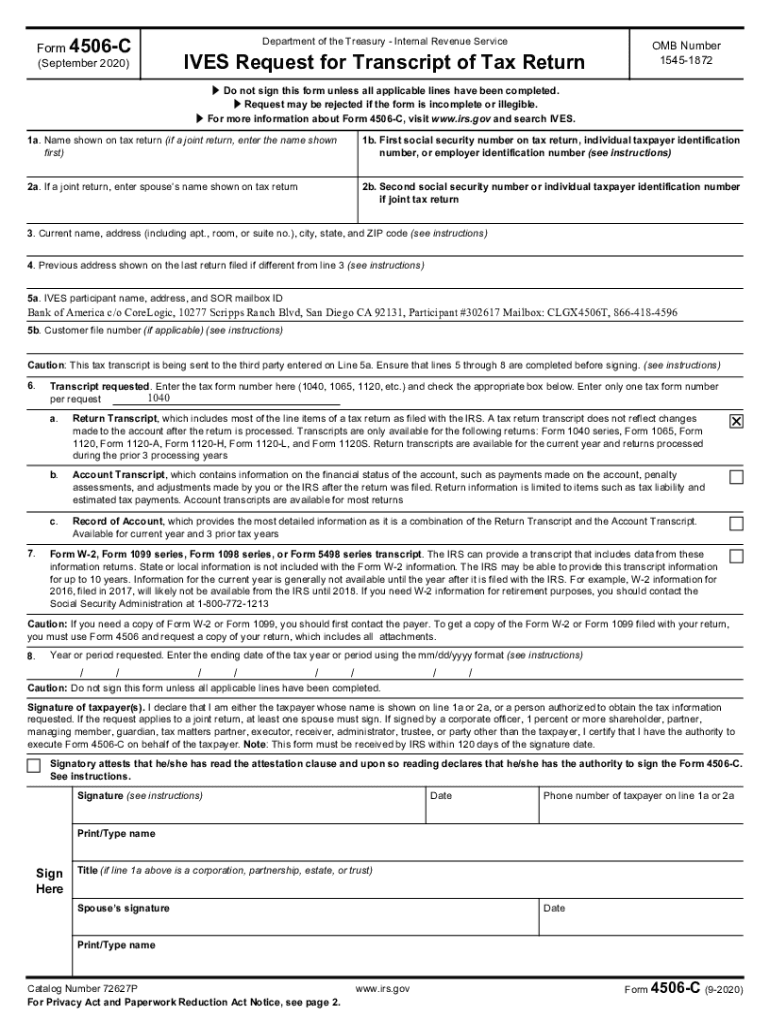

4506 C Fillable Form Fill And Sign Printable Template Online Us Legal Forms

Yearli Form 1095 C

Irs Form 1095 C The Best Way To Fill It Out Wondershare Pdfelement

2

1095 C Electronic Consent News Illinois State

Accurate 1095 C Forms Reporting A Primer Integrity Data

2

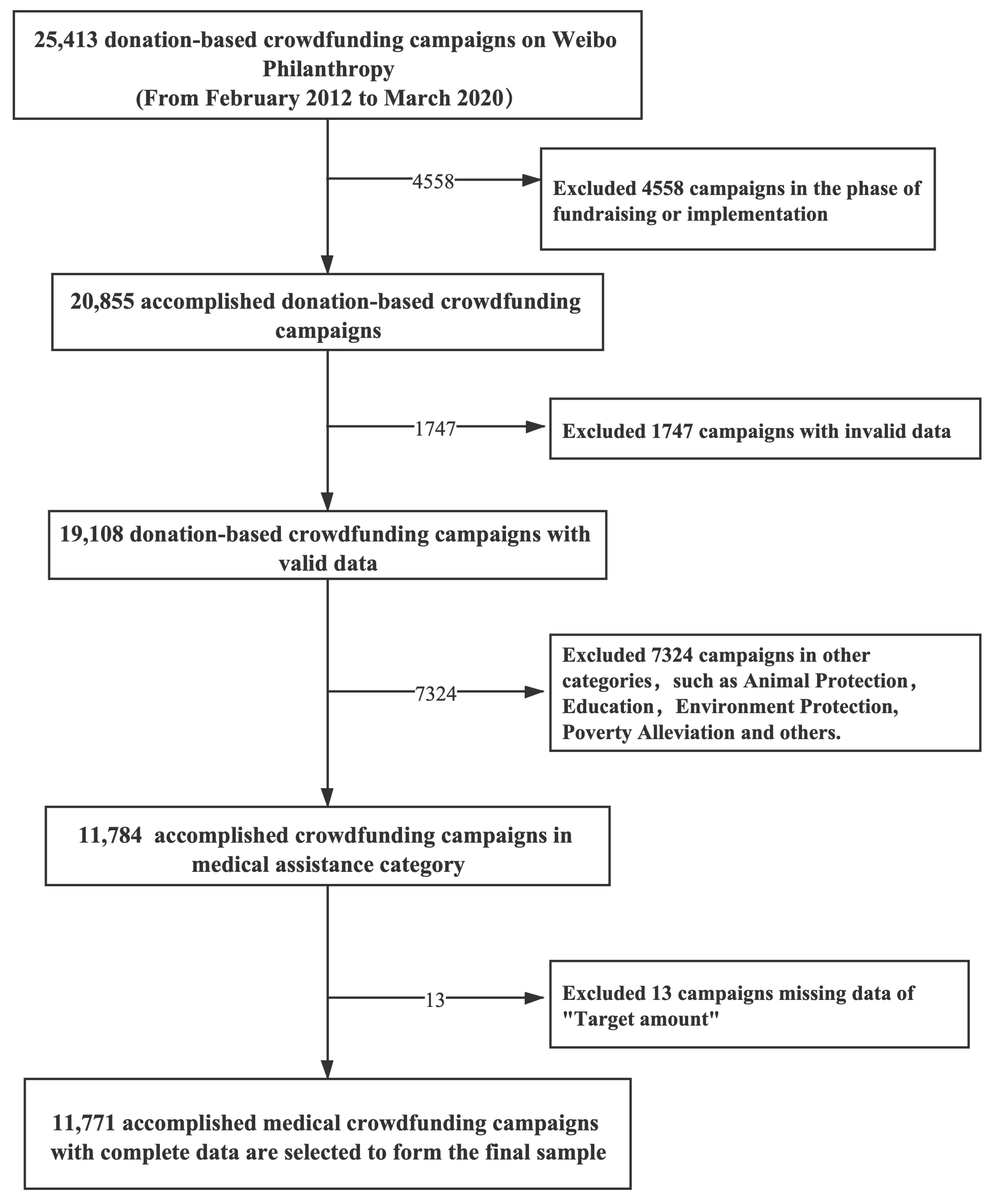

Electronics Free Full Text Predicting Fundraising Performance In Medical Crowdfunding Campaigns Using Machine Learning Html

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Changes Coming For 1095 C Form Tango Health Tango Health

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

About Form 1095 A Health Insurance Marketplace Statement Definition

1095c Form Acaprime Com

Sources For Forms 1095 C And 1094 C And1095 C Xml

No comments:

Post a Comment